startups solving loneliness

The distribution of deposits in scheduled commercial banks(SCBs) across the Indian economy reaffirms that India is fundamentally an ascending world country.

It appears that Indian Households are poised as significant potential consumers. It will be interesting to see how startups position themselves towards B2C services and product offerings that appeal to this sector.

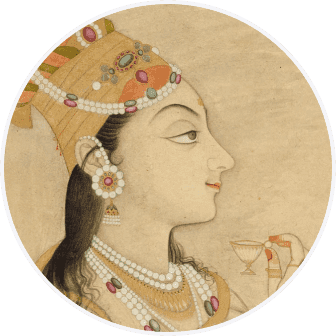

This represents a sizeable yet underutilised female demographic, a growth opportunity waiting to be tapped for startups. Women centric consumption will become a macro trend as a second order effect. Think maternity care, female hygiene, beauty, women-centric fashion and more.

It was always obvious that the highest revenue opportunity is in the Indian Metro scene. There exists mainstream relevance and aspiration for folks outside of these spaces. The road to higher likelihood of growth and profitability leads through the Indian Metro.

On one hand, these corporations are likely competition for startups. But? On the other hand, they can also be viewed as potential clients. B2B startups that offer valuable services to these corporations, such as SaaS solutions, stand to gain from this.

It creates an opportunity for FinTech startups seeking to disrupt or foster partnerships.

Link to RBI data: https://dbie.rbi.org.in/DBIE/dbie.rbi?site=BsrPublications#!21

Excellent writeup

Thanks for sharing this note @salt!

@AlphaGrindset Thanks :D

I don't think viewing just assets is fair, you should also look at the total debt held by these households and corporations.

Balance sheet math needed, can't look at credit without debt.

startups solving loneliness

HDFC, SBI, ICICI clearly the strongest. Startup credit companies usually work with Federal Bank, but they seem to be missing from this list, that's a bit weird?

Can somebody from the fintech domain help me understand?

Absolutely sad to see the state of the startups, most of them. I am a founder myself, and this is a post with equal disappointment with myself as much as it is for anyone else who relates. Look at all these companies that have raised s...

Specifically a question to all the t1 tech clg grads (mainly software engineers) earning 1l+ pm out of clg with a lot of scope for growth. Post mba avg salary is 1.5l per month.

I can understand ppl desperate for a career change and ...

I can share, I was working abroad post my T1 engineering. So you can imagine it must be > 1L. Like all those co...