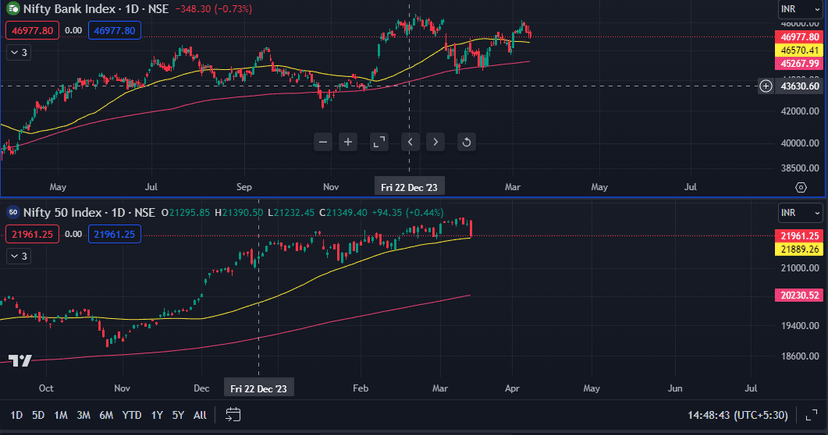

The broad trajectory of the market is going to be up with volatility. Some adjustments need to be made to the trading style.

https://share.gvine.app/yXc9GETSiWn8c2Uz8

In this post i had stated that ICICI is setting up for the move. I entered 50% last week, and i have fully scaled-in this week.

There are 2 themes in the market right now. The one that has momentum for eg, Nifty Oil and Gas, Energy , PSU, AUTO. These sectors have underlying momentum but risk reward is not great, these can exhibit crazy movements but volatility can kill your trade.

Other themes are Bank Nifty, FMCG, CONSUMPTION , METAL.Risk reward exits here. These sectors are under performing and undervalued in the current market context. From here on i am only going to build new positions in these sectors. For eg in Bank i have built positions in SBI, ICICI, now Axis if it sets up.

SBI is taking its sweet time, consolidation is healthy. I want to build another 200 quantities so i am buying 20 25 stocks daily to take advantage of the volatility. It will set up again and move up.

Let's see how things progress.