I had explained in the last post the sectors i am going behind from here on.

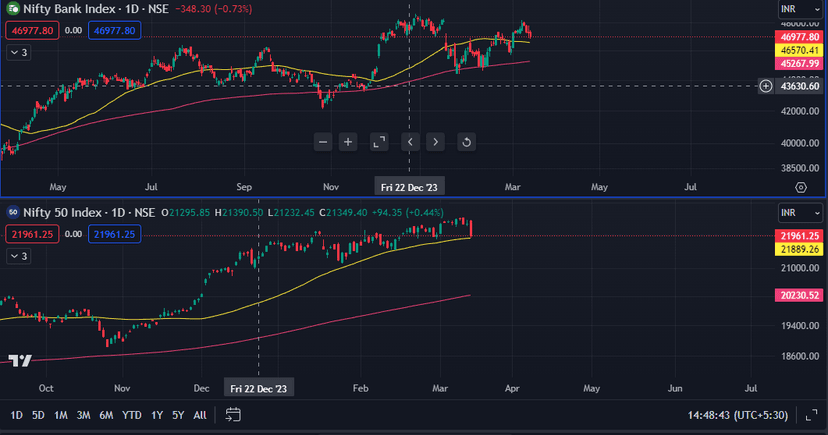

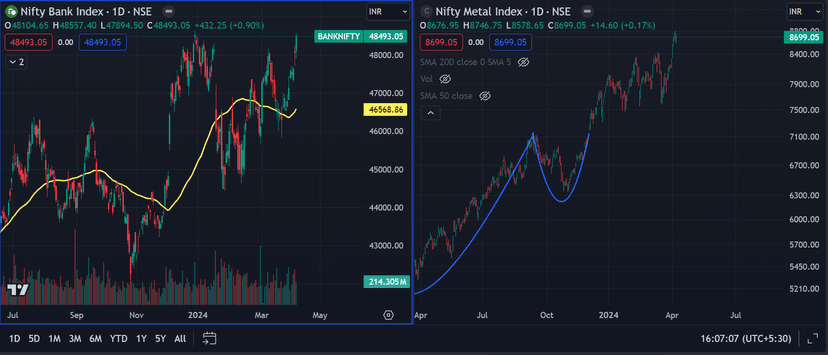

These were Banks, Metals and FMCG. Banks are resisting the fall even today & are broadly up. Check it here.

https://share.gvine.app/GiMiy13zbhGLgrT97

SBI,ICICI,AXIS are the top stocks in the banking sector & they are doing okay, well above buy price.

From FMCG Nestle, VBL, TATA C are well above the buy price for now.

From metals i have positions in Jindal & Tata S. I have cut out Jindal S today at 2% loss & i have Tata S from a much lower level so i am not worried.

Apart from these i built positions in TVS Motor, Cipla, booked out a loss of around 1.5% -2% today.

Cutting out stocks when things are not in your favour is also a skill and i have learned it the hard way. -2% can become -5% -10% very easily.

For the last 1 month i have been writing that Risk : Reward exists in Bank, Metal and FMCG and stocks from these sectors have not fallen that much in the last week.

Any chart pattern any strategy cannot be a traders edge, Risk management combining with Risk : Reward analysis & sector understanding is my biggest edge over 99% of market participants.

Now, markets are getting thinner by each passing session. I will aggressively start cutting position if we breach 21850 in Nifty. I am now only managing newer positions (mentioned above).

From the Large cap portfolio i built in Dec, i have a good cushion but i will start trimming if 21850 goes in Nifty. I will not touch my Top 4 holdings. I have Tata M, Tata C, LT , Can B , PNB , TATA S, Wipro from DEC.

I have a different account for Small - mid cap & i have booked everything except 2 top massive winner stocks in the last 1 week. I will wait for stability to return to build newer positions.

From now on whatever new position i build that is going to be from Nifty 100 index only.

Per trade I risk 2% of my account size but from here on my risk will be capped at 0.5-0.75% of Account.

Tip : Stay away from options for 1 Month.