Here is Link to my last post :

https://share.gvine.app/xA7YknDqHukqJ5Hq8

Japanese markets have fallen to the level of June 2023 in just a few sessions. Such is the nature of the markets.

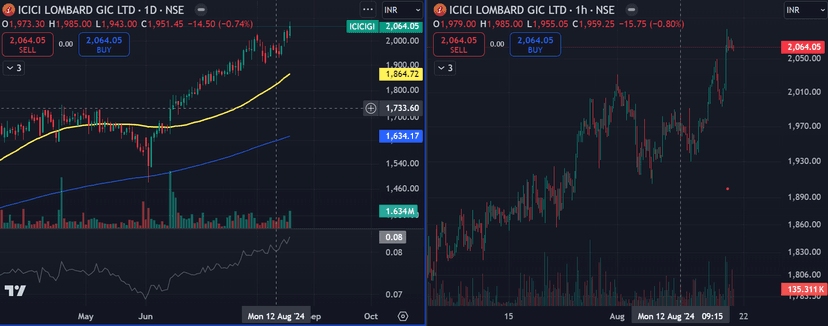

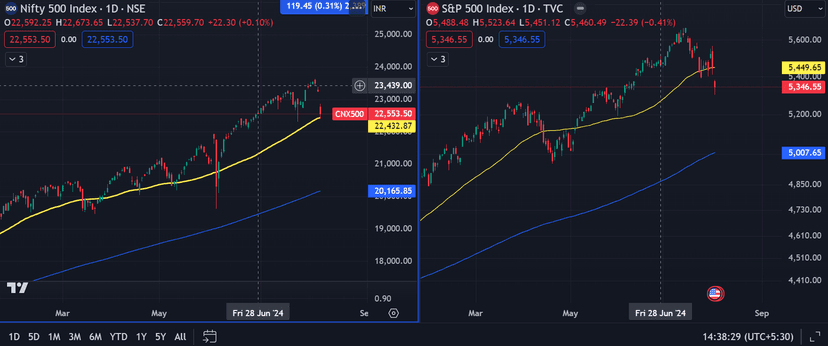

To gauge the sentiment of the market technically, i look at Sectors, broader market indices and stocks above and below 50 DMA (Short term trend) and 200 DMA(Long term trend). These are not any magic indicators one can use for buy or sell. Just plot it on major indices and see how beautifully they keep visiting it in bull markets. This has been happening for around 100 years and will happen for 100 next.

-

SPX, Nasdaq, and Russell 2000 are well below 50 DMA.

-

Japanese and Korean markets are well below 200 DMA.

-

Hong Kong is 50 DMA.

-

DAX (German), CAC (French), and FTSE (UK) are below 50, 200 DMA.

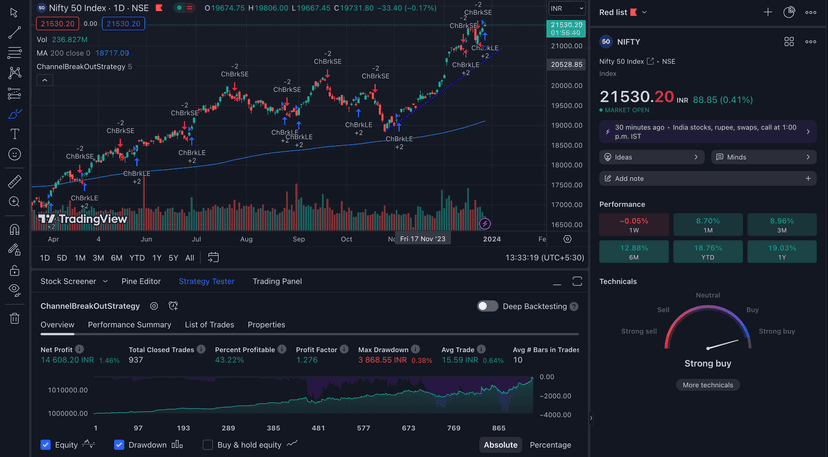

Thanks to our RBI, we are holding up well and we are testing out 50 DMA today on Nifty 50 and Nifty 500. A lot of DII money is coming in, but we are going to take a hit eventually.Most probably, we will fill out the gap that has formed today. We will see some bit of buying happening before that much-needed 'Correction'. I don't think we will have a vertical fall just like that. A bounce will come on the upside. There is still not a lot of fear on the streets. Now, that doesn't mean I'll go and buy blindly today.

Now I will explain what I did in my portfolio in the last month and what I will do from here on.

I cut down on silver trade with 2.5% loss.

I had written in my last post that I am booking profits from all my trades except for 2 stocks. Three weeks before the budget, I started offloading all my positions, selling 5-10 shares of each stock every day to get that average price if markets keep moving up. What an exit it turned out to be. Phew. Sometimes you get these things right, sometimes wrong. I clearly mentioned that I don't mind if I miss out on a few % gains from here. But I want to protect my profits. If you know how to make money, a few % doesn't matter.

As I was booking profits, I was bringing that money into ETFs. I had even written that I'll be buying IT, FMCG, and AUTO as my ETF choice, a mix of high beta and defensive sectors. Even with ETFs, I was outperforming the markets. Nifty 500 after that went up 6.4%, whereas the IT ETF was up around 14%, FMCG made a high of 9.20%, and Auto was just around the buy price. The trick is to identify the sector that is leading the market. (Auto was not a leading sector , it was CPSE and PSE, Auto was a contra bet).

What have I done today? 80% of my money was in ETFs. Booked an IT ETF completely today with a 6% gain and Auto ETF with a 2% loss. I will again look at the IT ETF after it tests out 50 DMA. I am letting FMCG run. I am 65% cash today with just one click exit from 2 ETFs. I won't try to be cheeky and pick up any stock today. If I want to build positions, I will do it through ETFs only for the time being. Again, sectors on my radar are IT, CPSE, PSE, PSU BANK. These sectors are still above trending pivot and are testing out 50 DMA. ETFs are not 'sexy' but they are excellent to manage when you have crazy volatility.

IT and FMCG are the sectors I had identified in my last post where I want to build long term trading positions. Initially, when things were not clear which stocks I needed to get in, I traded them through ETFs. Now, when pullback/correction is happening, I will identify leaders from these sectors and then will go behind them.

What if I had built positions in the last month in stocks? I would have followed my risk management to the T.

-

Any position built in the last month that was up 5-7-8% if coming back to buy price - Cut 50%.

-

Stock breaking trending pivot on an hourly timeframe get out 100%.

-

Any stock going below the breakout candle - Cut 50% and rest 50% at either trending pivot breakdown on Hourly.

You can always make more money. But you need money for that. Capital protection should be paramount. -5% can quickly become -10%, -15%, and then trades become long-term investments and you get stuck.

As for long-term investors, you need to weather out the storm and be prepared for pain for the next 12 odd months. Keep bringing in new money through SIPs into stocks and absorb all the volatility.

We are in an amazing long-term bull cycle and this is just a blip.