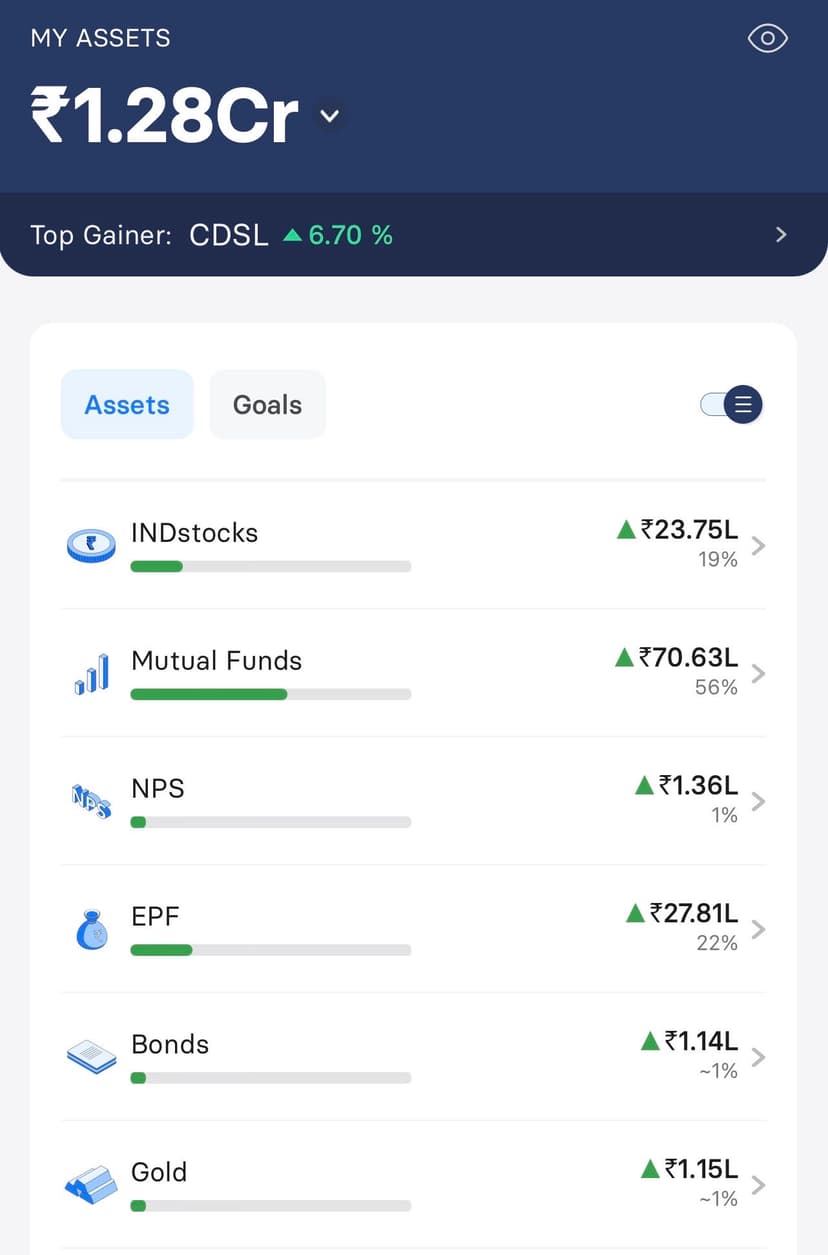

Seeking Advice - Portfolio Check

Age - 33 YOE - ~ 10 years in Marketing

Zero exposure to US stocks. Zero exposure to Crypto. Have a house (~45 lacs) for parents in a Tier 2 city which I haven’t added here. No liabilities (finished an education loan and a home loan)

...