Home Loan Crisis in India 📈

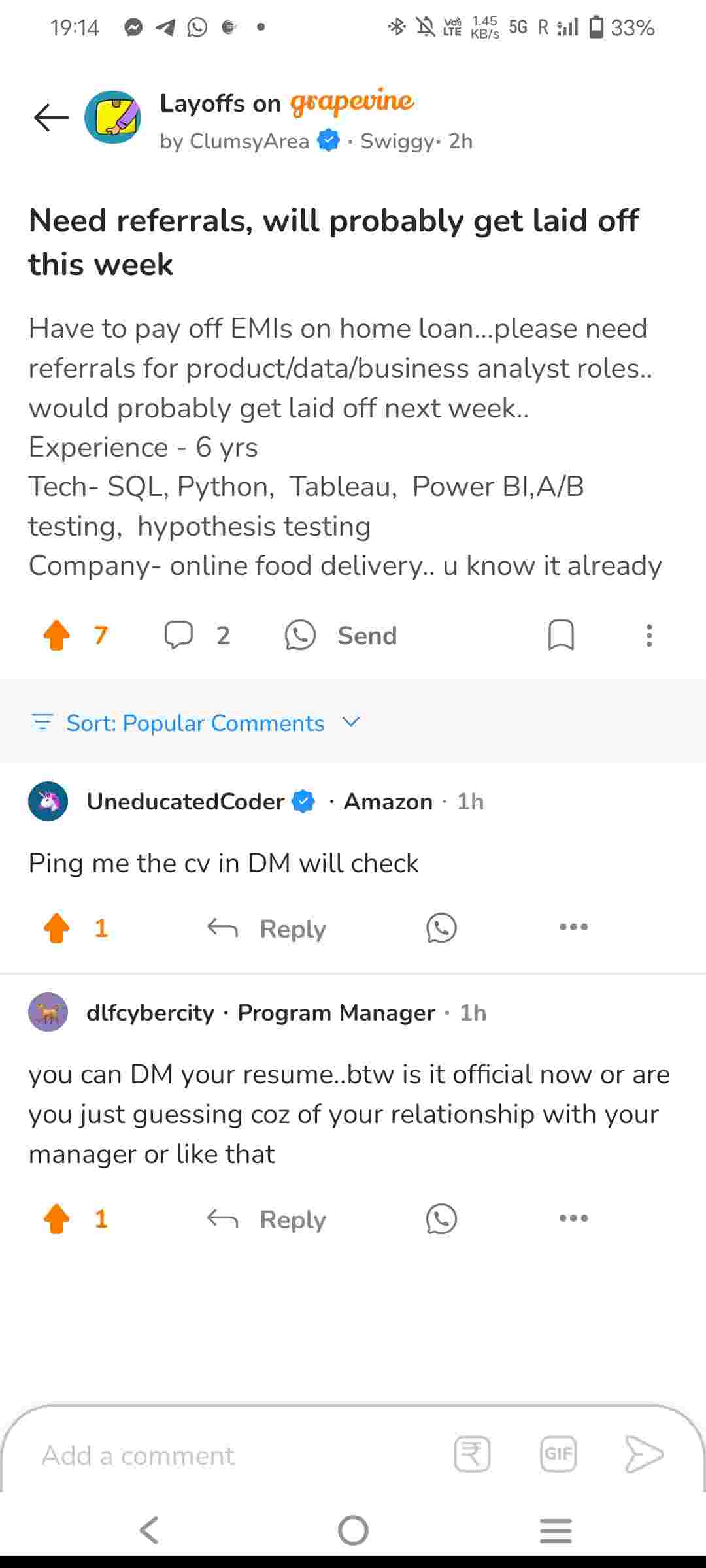

I was thinking about this few days back...Today a swiggy employee validated my thoughts so posting here.

Layoffs are mainly in cream jobs(20-30% which is hardly 2-3cr source tax web) and in India mainly home loans or highly consumable loans like car or PL are taken by White collars...As per labour law, we ain't protected like in Korea.

So, if someone or let's say a major chunk loses his or her job then how the system will absorb this default?

Some data...

Fy23 Home loan Size is 20 lac crore or $250B (15% of total loans disbursed by amount)

2030 it's about to touch $1T

Cagr 23% in HL growth 📈

What if defaults rise in dual digit?

Plus exorbitant hike in flat price like literally greater Noida West have 5lac unsold flat but still 10lacs worth flats are being sold at 40-50lacs (poor quality and seelan issues after a month)

PS - Usa and China have seen this. (2008 and ongoing in China)

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

The best time to buy was after demo and during COVID. The youtubers who gave bull shit recommendation of rent vs buy should be jailed. The price to income ratio today is actually less compared to 2008. However, the main difference is that those who started career since 2010 has seen only one way growth due to zirp. Any inversion to mean will be shocking to many to say the least.

Hope the central planners will be able to smoothen out the curve however will the capitalists let this? There is billions to be made in shorting. This is how modern day slavery works.

💯

Few questions that you should find answers to for your assertion to hold true:

- how have residential prices trended in the last 10 years | How have they trended in the last one/two years (If there's a housing bubble, prices should be growing abnormally, and everywhere, not just in upcoming pockets)

- How have NPAs (mostly GNPA) for housing loans by top banks trended in the last 10 years and last one year (If people are defaulting, early buckets should start seeing stress)

- How have EMIs evolved because of the rise in interest rates over the last two years (2023 vs 2020) | How does it compare to white collar salary increases (Has loan paying capacity significantly deteriorated?)

- What is the level of indebtedness in white collar workers? Has it increased abnormally over the last 2 years? (If existing loan payers default and houses go on market, does rest of population have the capacity to absorb that)

Please don't believe these industry numbers for FY30. Unless the market was growing at 30% over last 7-8 years, there's no reason how it can grow this much over next 7-8 years. As far as I know, retail loans which have seen unprecedented tech improved, have also only grown by 15% over last decade.

VC view...loved this...but still am intrigued about a debt crisis

We needed a funding apocalypse for this specifically. Indian millennials have crazy spending habits. I have friends who have taken home loans which will take ... Wait for it.. 35 years to clear ! That means they will have to pay EMIs even after age of 60. 😱

Home loan crisis in India will begin due to low fertility rates, good properties (quality and location wise) will not face any issue, Many of my friends have properties where they have paid more money ( actual price + loan interest) than market price of apartment, crisis is already in inital stage, luxury segment will get hit last

A good read for Economics and Finance fanatics -