Acche din

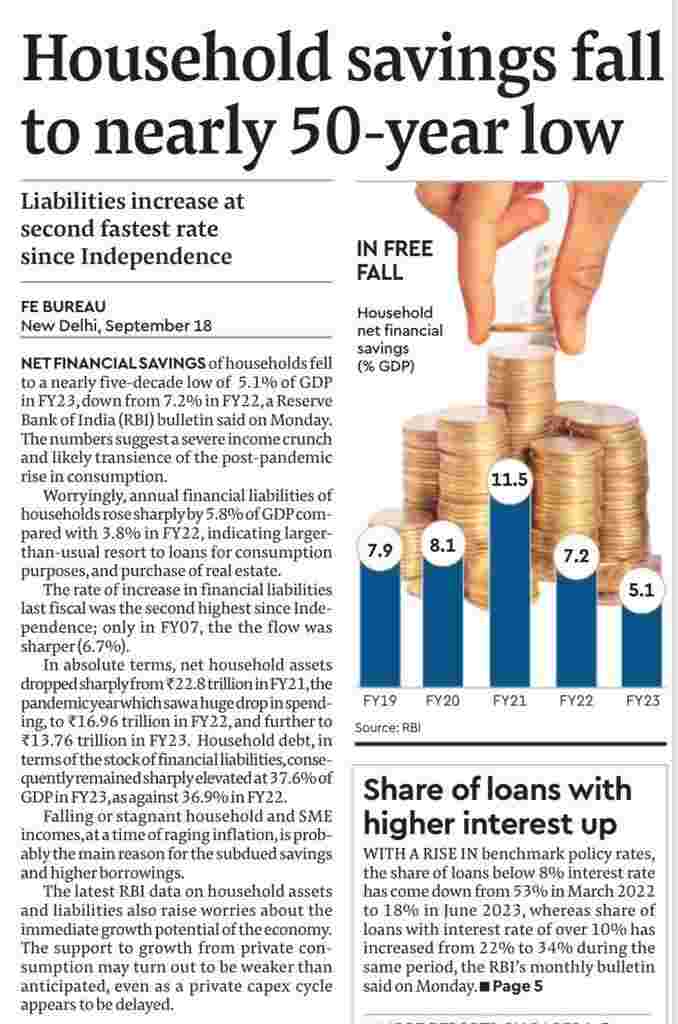

Liabilities and high interest loans rising, household savings falling. It's a very worrying statistic if people are borrowing money just to stay afloat.

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

Correlation is not causation, less savings doesn't imply there's no money with people, it could very well be increased spending.

Most of the consumption led kpis show uptick, that shouldn't be a bad thing.

Over the past decade even basics like denim usage in India has grown so much that factories domestic/export share change reflects this all with increased capacity.

More upmarket categories have witnessed multi fold increase, look at any of luxury car sales growth, Apple revenue in India (inr 450cr in fy10 → inr 50,000cr fy23) You'll surely find many for data.

It's good if even black money is being spent instead of being hoarded, and yes if a govt school teacher giving extra tution earns 50k cash it technically still is black money, and now if he buys that 55inch 4k tv it's good for the economy, it wouldn't have helped anyone if that 50k is hidden under the bed.

west has peak examples of debt leveraged lifestyles, it hasn't collapsed their society yet,

We don't know if the consumption uptick is being led by borrowed money though. Consumption was already at record lows back in 2019. Add to it inflation in food and fuel prices, along with falling wages and less jobs, I don't think the average Indian is going to be buying TVs and iPhones any time soon.

True. Also, Luxury and iPhones are for the top 1% or lower than that. Data shows the top 1% has grown. There will be more spending There.

It's the lower strata that's always affected

Savings depletion post-Covid is UNIVERSALLY true. Congi Pidis (not saying you are one, but happy to be proven wrong) everywhere are breaking into alarmist rants, which it isn't.

As per the data, it seems there is a massive covid based REVENGE SPENDING among Indians. Plenty are resorting to loans to buy real estate too. At any rate, savings going up will be effected with a lag effect as the covid led disruptions are normalised.

A much better data entirely given a miss by the useful idiots is this: Net new job additions are 2.27 crore from FY20-23. Given there was covid in between, it won't be a jump to predict that India is creating ~1+ Crore new jobs annually. This demolishes the bogey of jobless growth.

Acche Din indeed.

To add to the above. Growth is not even across all sectors. We are possibly witnessing a K-shaped recovery, although Subramaniam disagrees. Will take some time for the seeming imbalances to iron out.

Do you always start your conversations with name calling, insults and judgements? That too with people you don't know?

Lmao, maybe people are not stupid enough to keep money idle in bank now and are investing in shares or real estate? Why do you think there is a boom in real estate?

This is useless data , curated to create hysteria. If economy is doing bad , why is industrial output increasing? Why is gdp growing at 7+?

Reading biased opinions don’t make you expert, critical thinking does

Net household assets have also dropped, please read the full article first in case you haven't

Yes because people are buying like anything

Ignore when it just says averages. Our per capital GDP is so low ($3k), so fluctuations in that are likely.

Big purchases like RE/Cars are going to reduce savings, increase liabilities drastically.

NBFC's have penetrated Consumer finance (Loans>10% interest) and electronics prices have established after the supply chain & chip shortage issues in 2021s. So a boost in that spending might explain some of those stats. The headline of liabilities increasing is misleading. Formal Credit growth occurs when lenders show confidence, not when households are struggling (coz they always are).

I ain't bullish, but these stats are useless. Move away from averages.

Better headlines: 2 wheeler sales declined (Rural economy worsening). GST receipts trend by category flattening (degrowth) Sales of key FMCGs (lifebuoy, parle G, men's underwear)

for the last couple of years the income remains stagnant but the inflation is high

not my opinion this would be considered good because the consumption fues economic activity

So you are just ignoring the term "rise of consumption"