NPS is best for 7LPA+ salaried. Are you investing? If not, why not?

NPS 80 CCD(1B) is the best low cost option if you can save additional 50k per year. It comes with a long lock-in but since we mostly don’t have jobs with pensions so it’s worth to get lakhs of Rupees when we retire. March is around so if anyone wants to invest quickly and save tax, can message me. Happy to help!

Talking product sense with Ridhi

9 min AI interview5 questions

No net saving of 50K, you're saving on 50K. Eg. 30% of 50K is 15K. Savings of 15K not 50K

You misunderstood it! My point was you should invest if you are financially sound to “save” additional 50k from your total expenses then you should utilise the option.

No requesting to re-read your post- line#2

"If you can save additional 50k per year"...

Now I personally don't enough value in saving 15k just to have money while at age of 65+ what's the point.

On an initial glance, it looks good.

But having made the calculations time and time again it never made sense once you consider below points -

-

Maximum 75% of portfolio can be in equity, rest 25% has to be in Govt or Corp bonds. So even with 30 years lock-in you still can't have it all in equity.

-

If your age is less than 45, then investing (50 - 15) = 35k in Nifty 50 shall yield better post tax return when you hit 60.

-

At maturity, 40% has to be used to buy annuity. Don't like the lack of flexibility. Besides all the annuity products offered are shit.

-

I don't plan on working till I am 60. In such case why would I plan my finances as if my retirement shall begin at 60 which NPS assumes.

Best tax saving instrument out there. Period.

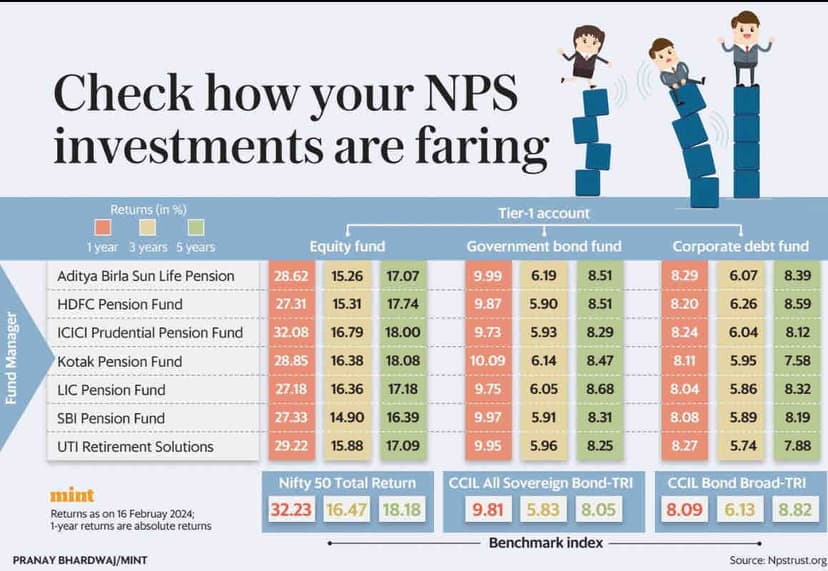

- Equity returns

- Tax benefit for own-50k

- Tax benefit if employer adds-10% of basic, no limit.

- Can include in 80c as well, above 2 are separate.

- 60% corpus at time of retirement is tax free. Rest goes into annuities.

Point 3. Tax benefit for employer contribution to NPS and EPF upto 7.5 Lakhs in a year

What a nice headache to have

Can’t I make it 100% equity, since I’m <30? Can NPS ever beat NIFTY50 or NIFTY100 ?

Please always follow asset allocation. You should have at least 30% invested in bonds/FD/Gold physical or gold bonds. NPS saves tax too.

How can I invest?

Is investing in NPS worth it?

Should we invest in NPS if you are falling under higher tax bracket of ~30%? I am having income of 20+ LPA. I did some calculations investing same amount of money in mutual fund sip the return is much higher than NPS. What confuses me is...

Any opinions about if one should invest in NPS or not.

Consider investing in NPS and taking the tax benefit (however locking money until 60 atleast) vs investing in mutual funds.

Please share your thoughts if its worth the tax benefit.

NPS worth it?

Hey folks, I’m amidst planning my taxes. I believe one can save more in taxes if invested in national pension scheme under 80CCD.

I have already opened a NPS tier-1 account with PRAN ID generated. The only thing that is keeping me away...