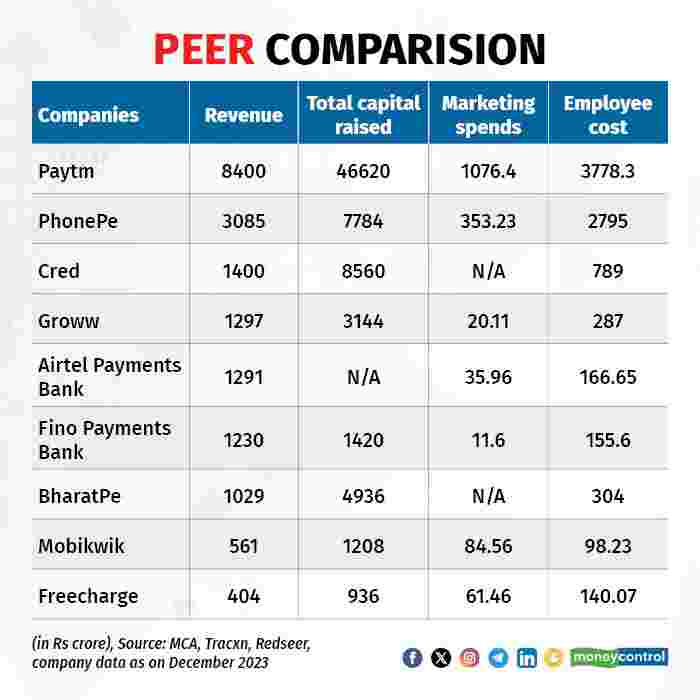

Cred

Cred is truly a topic of surprise for me. Yes, I understand it has created a community of top spenders/credit worthy people in India. I also understand that they can use the information on such people for creating value for themselves.

...

I feel cred is doomed and just trying to increase its value. And the end goal is to sell the cred to someone with h...

It is doomed. If they layoff I hope they fire the UI/UX design first for such an atrocious app design