Do you think NPS is good, assuming if 80CCD(2) tax benefit is available?

NPS has two major tax benefits, self nps contribution has only 50k tax benefit (above the usual 80c), that too only for Old Tax regime. But if you have the option of availing employer’s nps portion (under 80CCD(2)), which gets you benefit of upto 14% of Basic (or 7.5 lakhs-PF, whichever is lower) under New Tax regime, and 10% under Old regime. So what do you think, is it worth it?

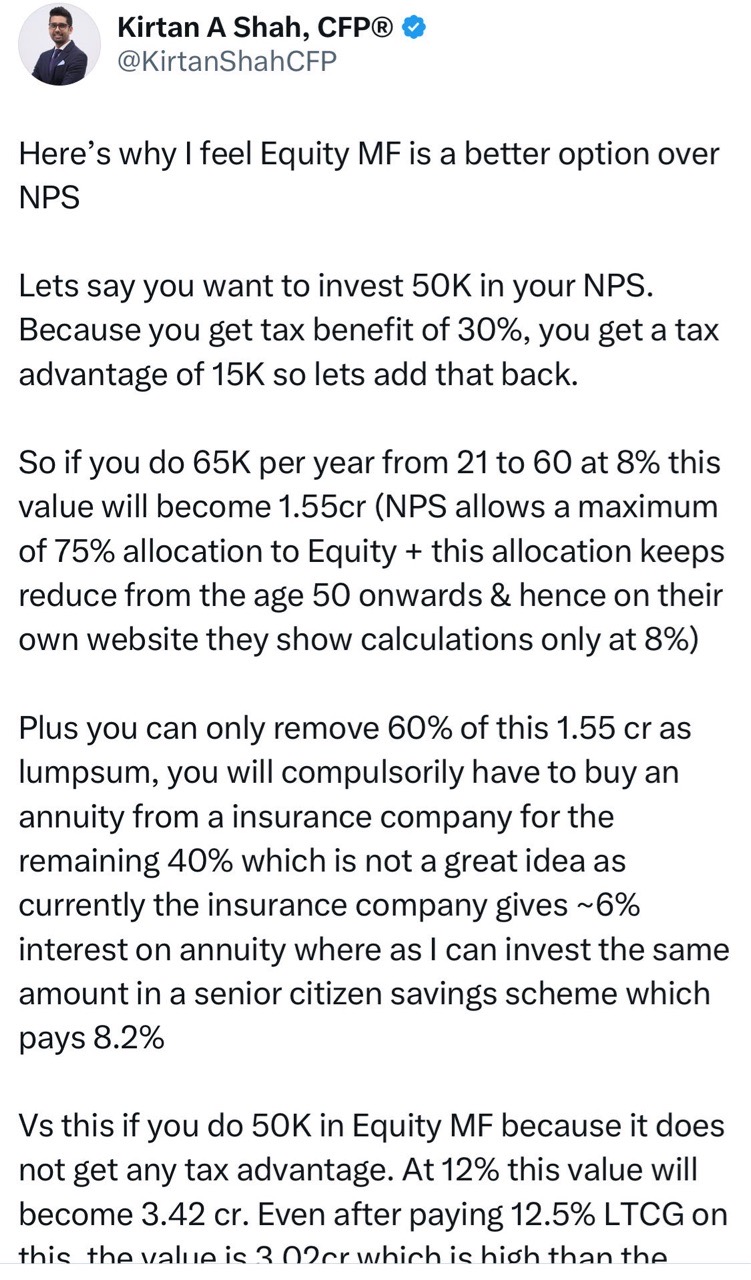

Personally, as of now, I am still not convinced of its worth, primarily due to two factors- (1) You can never withdraw entire amount (2) The 40% you reinvest post 60 yrs, which shows to get you pension of, say 50k/month, is all with so much of assumptions, and even then it looks small value compared to the 40% they are forcing you to keep invested. I mean if you invest 1 crore in FD, may be you get more than that pension! So unless they guarantee some minimum pension amount (even very low), it looks all so dubious, like some chit fund scam.

So what do you think, would you go for NPS, if you are getting employer’s portion part, with tax benefit under 80CCD(2) ?

One interview, 1000+ job opportunities

Take a 10-min AI interview to qualify for numerous real jobs auto-matched to your profile 🔑

I did a quick calc comparing nps to investing in conservative bond+equity hybrids over a period of 30 years. Not worth it simply for the fact that money is locked till retirement and the pension amount will be too little when factoring inflation.

Yes, that’s my main point of contention too. That’s why I never opted for it till now. But now I am having to pay fat taxes, and I am having to reconsider a bit.

If you are paying 10 lakhs tax, you pay only 8 lakhs tax if you use this. Just that you need to deposit 3-4 lakhs in NPS. (Just a rough calculation above).

So the competing thought is, is it worth it, to deposit 2 lakhs in NPS, to save 1 lakhs tax? That 1 lakh tax paid, will never come back, but the 2 lakhs NPS deposited “may” come back. That’s why I am still a bit undecided on this.

Similar mindset to you OP - taxation rules can change making it harder to take out the money. Also, inflation-linked annuities aren't there yet in the Indian market so buying them and making a reasonable assumption on future inflation is a guessing game. I do not trust the govt stats on this. There is a reason why many states are reverting to the old pension scheme and which RBI is worried about. Hence, not investing in NPS

Exactly, my 3rd reason of apprehension is that same- that it is Govt scheme, and Govt schemes are always so shady, with so much of redtape. We are already reading so many news about people facing issues with withdrawing NPS amount when they approach those guys. Complete rotten system. And yes, the ever changing tax schemes too.

But then, I am still in two minds on this. If you are paying 10 lakhs tax, you pay only 8 lakhs tax if you use this. Just that you need to deposit 3-4 lakhs in NPS. (Just a rough calculation above).

So the competing thought is, is it worth it, to deposit 2 lakhs in NPS, to save 1 lakhs tax? That 1 lakh tax paid, will never come back, but the 2 lakhs NPS deposited “may” come back. That’s why I am still a bit undecided on this.

The employer is giving you more money if you opt for it right? So shouldn't it be good?

No, employer doesn’t give more money. The money just gets deducted from CTC, and goes as employer portion, just like it happens in employer portion of PF. PF is mandatory in most cases, but NPS is completely optional. My organisation gives NPS option as a flexi benefit, you can choose to have it cut out of your CTC as employer NPS, or you can choose to have it full in-hand no nps.

Update: Despite overwhelming people voting for Yes, I chose not to go for NPS option, at least for this FY. There are just too many unknowns, so couldn’t decide to get my money stuck in NPS.