I was thinking about this few days back...Today a swiggy employee validated my thoughts so posting here.

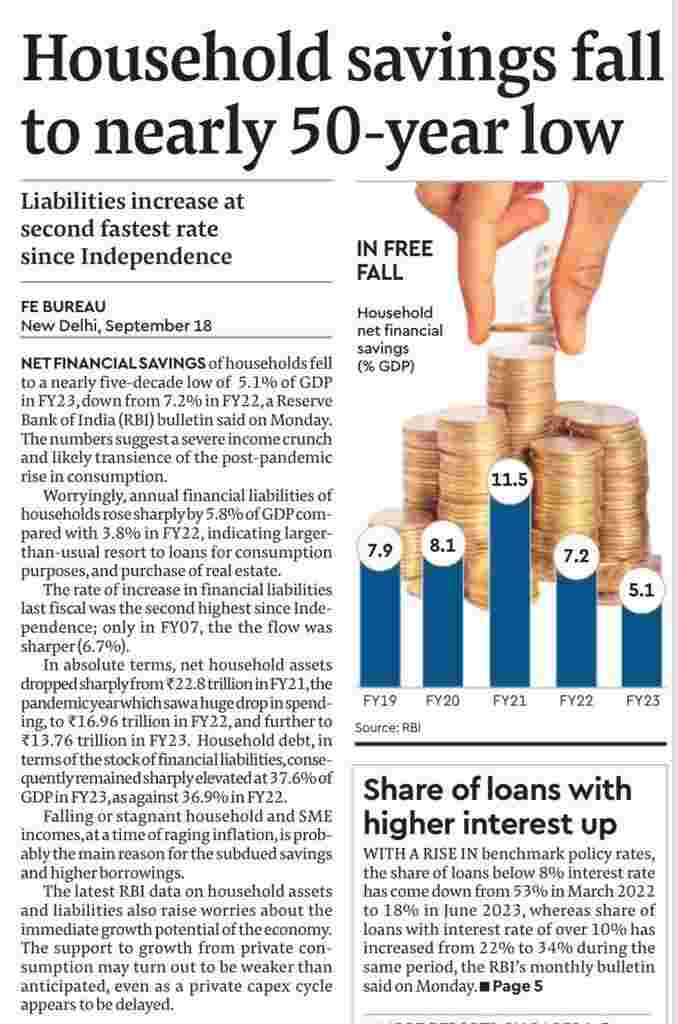

Layoffs are mainly in cream jobs(20-30% which is hardly 2-3cr source tax web) and in India mainly home loans or highly consumable loans like car or PL are taken by White collars...As per labour law, we ain't protected like in Korea.

So, if someone or let's say a major chunk loses his or her job then how the system will absorb this default?

Some data...

Fy23 Home loan Size is 20 lac crore or $250B (15% of total loans disbursed by amount)

2030 it's about to touch $1T

Cagr 23% in HL growth 📈

What if defaults rise in dual digit?

Plus exorbitant hike in flat price like literally greater Noida West have 5lac unsold flat but still 10lacs worth flats are being sold at 40-50lacs (poor quality and seelan issues after a month)

PS - Usa and China have seen this. (2008 and ongoing in China)