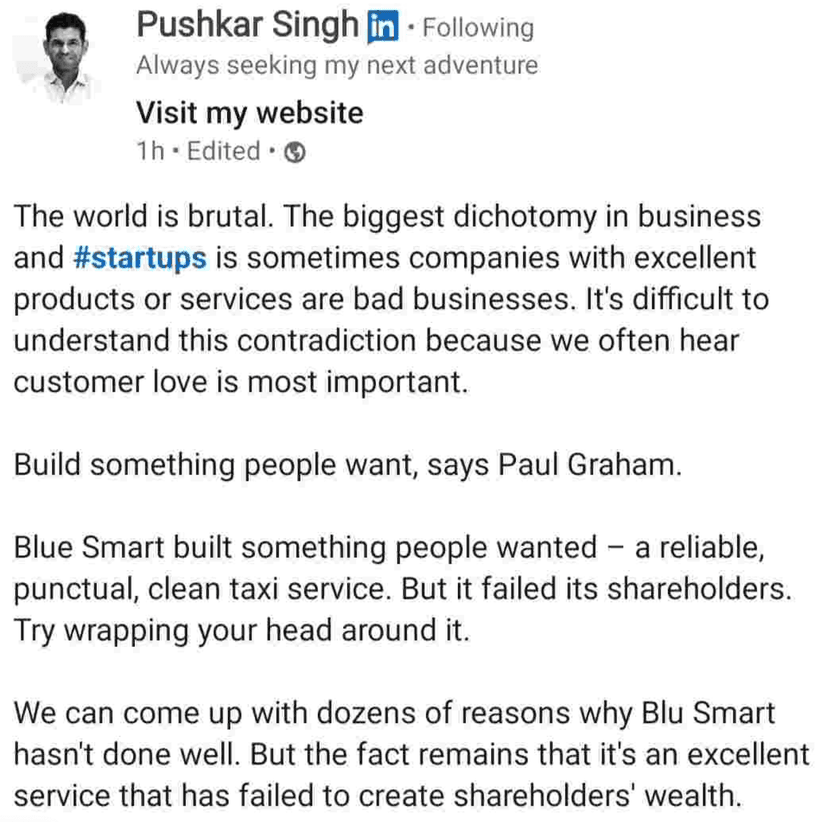

Why is figuring out the Indian problem & giving an Indian solution very hard? 🤔🤔

In Startup ecosystem

There are essentially four parties in the startup economy:

Now let's look at Game Theory motivations:

The Indian Consumer wants to minimise money spent per unit value extracted, the Western Consumer wants to maximise value extracted per unit money spent. (There's a massive difference.)

The Startup depending on the stage wants to maximise User Growth and Free Cash Flows.

The Service provider wants to maximise financial incentives.

The Investor is wants to maximise the XIRR of their fund. For this they need to reach a multibagger liquidity event.

Now let's look at what happens when:

The startup attains pricing power through deep competitive moats allowing for monopolisation. They can jack up the prices to ensure nice FCF, greater rewards for Service Providers and great returns to their investors. (Think, Uber can charge anything to you now)

The users get bang for their buck, the service providers get good incentives, the investors push for higher growth but unfortunately the startup does not have enough capital to service their Cost of Operations through their unit economics, so they will either run out of cash or investor patience. Either ways, they are doomed. (Think every legit startup that failed)

This is the likeliest scenario as they have the least power in this dynamic. Rewards will be reduced over time or made harder to achieve. They have no option because they got no option for sustenance. (Think any on-demand service providing app)

Now imagine there is a startup that can balance the act very well. They have a service that users are willing to pay a margin on. They pay their service providers fairly and have decent unit economics. Now, the investor will do halla about destruction of shareholder value from little growth. (Is this the case with BluSmart?)

Maybe that's why building in India is tough.

This is exactly how it is. Indian consumers lack the purchasing power to pay higher margins on goods and will often resort to petty discount hunting.

I have come to realise a similar things as well.

Indians are mostly stressed on money. We prefer utility/value over luxury. Most of the times. We wouldn't buy games for 5k Rs online.

Unless it's marriage and then it becomes about status and people end up spending 20L hard earned cash.

Until purchasing power of Indians go up, we would want a 10 min delivery but not the delivery charges.

Great points made. Maybe investors will realise that the same revenue multiples for evaluating US startups aren't good for Indian ones and that they've been overvaluing Indian startups.

What are your thoughts on the impact something like that will have on the current Indian Startup ecosystem of let’s say valuation multiples are halved?

Having worked in startups that went bust, I believe founders will be more serious about PMF, unit economics, and unnecessary inorganic growth spends as well as high tech salaries.

Maximum Indian users will exploit every last bit of discount and then still cry online.

No. We have the TAM of the UK roughly ~50M online transacting customers with discretionary income. However, we raise US levels of Venture dollars resulting in this mess.

We just haven’t grown as fast as China is the issue. If China adds 1M people to the class of customers who have enough income to spend online a year then India adds 1/10th of that. Great businesses can and will be built in India. Look at the amount of profitable mid cap IPOs like EaseMyTrip, Zaggle and IdeaForge. These companies were successful in the public markets despite VCs claiming that you need to be a unicorn to list. We just need to revise the TAM and the valuations. We use PPP to compare salaries but not for valuations (this makes no sense). 500M should be the figure to qualify as an Indian Unicorn.

That’s actually a very interesting way to look at it. Rationalising valuations makes sense but it won’t happen because the only way VCs will make money on their investment is through higher valuations.

So, it is just a part of the game. Let easy money come and see what happens.

Yes. Because Indian VCs source capital from Foreign LPs. Foreign capital is like a shot of steroids. It allows you to reach that 50M customer figure in no time (Zepto is a great example) but then stuff starts looking bleak when you realise that customers aren’t getting richer.

The problem with Blu Smart is it's not a reliable on-demand cab provider. Almost always cabs are unavailable in area like Whitefield.

However, it's great for pre-booked cabs. And if I have to pre-book only then there are numerous options like Deepam Cabs and those cabs too are mostly clean and punctual.

But personally for me, I prefer the reliability of BluSmart because on-demand sometimes sucks when you need it the most

I don't think there can be any happy startups.

Money is always made at the expense of parties involved. If somebody is making money, kisi ka to katt rha hai, be it employees or service providers, or consumers or the investors.

I also believe this is a very dark way to look at things, I so hope I start to see things in a more positive light.

As long as we have stock based wealth creation, someone would always want pump and dump

@No1_BusinessMan That is so ironic because if stock market participation increases then the index will roar crazy.

If we note, stock market is manipulated by news and operators. VC game is again the founder chasing valuation(instead of value creation) either to pump it up for next round by selling equity by bigger VCs. VCs proudly talk about "exits" instead of social/environment impact. PE is manipulated by SPAC and IPOs which is again pump and dump.

In short we are living in the age bubbles and scams 🤣🤣

In Startup ecosystem

Have been an entrepreneur since college days. Went full time on same idea and worked on it for a good 4 years full time before starting something new, raising some money, later pivoting (fucked up here) and eventually shutting shop last ...

The US is the land of dreams because of primarily 2 reasons: enough talented folks willing to take big risks and enough risk-capital providers. Both these pillars for India have issues. Let me explain.

First, there are no true risk take...

I had similar thoughts about the Indian startup ecosystem but soon realised that this is a pessimistic way of analysi...

Seen quite a few top/mid level exits in Tata Digital over the past two years.

Recent one is this https://m.economictimes.com/tech/technology/churn-on-tata-digital-loses-another-senior-executive-as-travel-head-subramanian-exits/amp_artic...