Was catching up with a friend of mine in Gurgaon for lunch today. Afterwards, his uncle joined us because they had to get some work done for his cousin's wedding. So, I came to know that he manages an equity fund for a popular wealth management fund in the country.

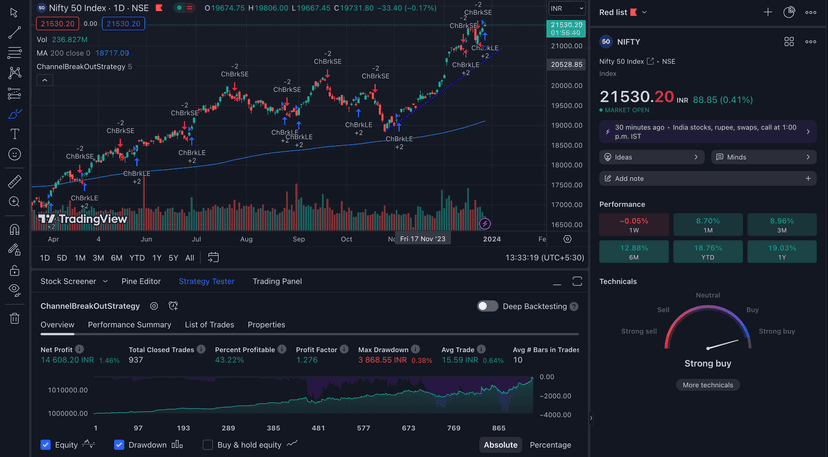

He was commenting on the recent rise in the market after quite some time now. According to him, we are maybe in the midst of a good bull run with good capital inflows already in the market. He mentioned that there will always be naysayers until the markets get overbought and then naysayers will start screaming that we're in a bull run when it is already too late by then to buy anything.

However he did mention two of his major concerns. FIIs combined hold a very significant amount of holdings in the Indian market when compared to DIIs, this means that there is some risk when they decide to book profits.

Secondly, he commented that it fine to trade as a hobby but remember that there are players in the market who will hunt stop losses during a bull run. You will never know when that happens. So avoid trading and buy and hold was his advice.