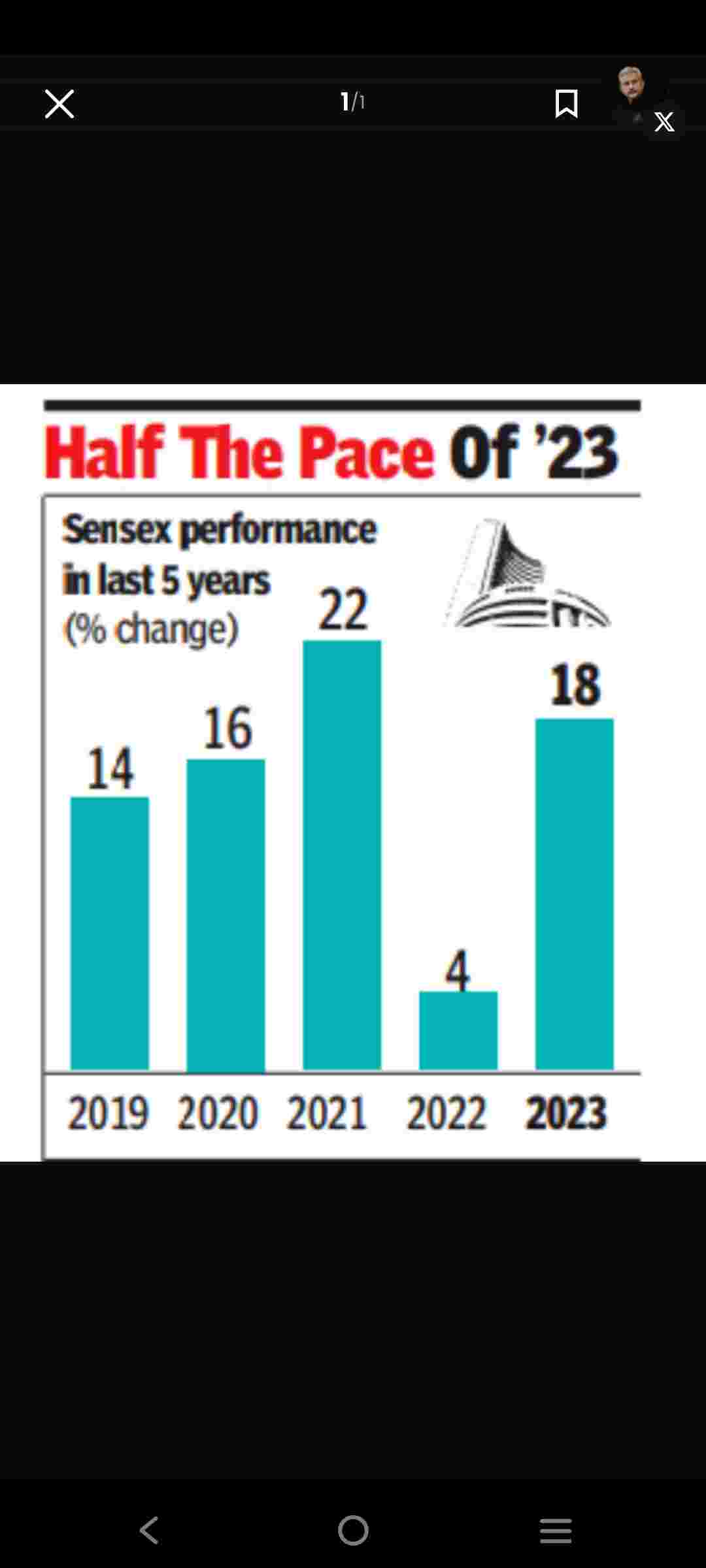

I think the US market sentiments were a bit positive in Q2 a bit and they made recovery on the recession signs at the start of the year, but now again signs are negative. Consumer demand is weak, interest rates are still high, talks about a soft landing on the recession making everyone itchy, nobody knows what the fuck to make of the bond yield curve. Global signs are also still mixed.

India is in a weird spot although everyone is bullish on the country's growth which we see priced in the numbers, we all know our IT sector will get nuked once the US goes into any kind of recession. Startups will shut down, MNCs will fire, demand will fall, bla bla bla.

Overall I think India would do well over the next few years even if the global economy shits the bed.